Stack Income Improve Since Abrupt Expenses online cash loan sri lanka Pop

Articles

As intense price happens, by using a funds improve seems like the solution. But it can be costly in case you don’michael pay off the progress regular.

Available funds breaks by way of a numbers of financial institutions. In this article alternatives have happier, hock shop credits and start wheel sentence in your essay credit.

Best

A people who need cash quickly consider best – little, short-key phrase loans with regard to $five hundred or significantly less which have been credited with their pursuing wages. These high-costs credit result in a planned monetary, and a lot of united states of america don legislation your boundary or constraint the idea. Any banks also employ deceptive strategies to try help to economically pressured individuals who seek these plans.

More satisfied often require the consumer to create a cheque in order to the bank to get a move forward stream along with bills or even allow the financial institution if you need to digitally remove money from their deposit, monetary relationship or even pre-paid explanation. Any rate of interest using a regular endless weeks of frustration-night time loan is actually five hundred% or higher. The issue-authorized pay day finance institutions posting credits from reduced bills and start short terminology, these forms of loans are more difficult arrive at.

Receiving a mortgage requires a legitimate bank-account and commence proof income. Using this, they will find the following move forward options difficult or perhaps extremely hard if you want to online cash loan sri lanka stack once they have zero banking account. 1000s of on the web pay day advance capital support claim they can type in speedily advance popularity, but it’s forced to begin to see the natural codes as a move forward in this field.

A banks definitely chance a financial validate, that might in a negative way surprise the borrower’s credit history. People might not run a financial verify, yet this could allow it to be more difficult if you want to qualify for the advance. This sort of varieties of breaks way too by no means tell the credit organizations, so as not to benefit you construct your economic.

Minute card Advancements

Card money advancements really are a kind of succinct-expression applying for to be able to borrow in your credit limit. Yet, this sort of asking for is usually better than other styles involving fiscal tending to rapidly mount up regarding desire expenses. A cash advance also can include expenditures your range from an appartment fee of a part of the money contemporary. A new credit card banks restriction the number of the borrowing limit you could possibly borrow with a greeting card payday, so it is required to know very well what the actual bound is prior to try this innovation. The credit card announcement, on the web description as well as cardmember set up usually supplies this information.

Most credit card issuers the ability to get a minute card pay day as a an Credit revulsion or simpleness tests. If you’ve found yourself a new straightforwardness affirm, a minute card program definitely have a tendency to downpayment it will within the put in justification with a week. You can even get a new payday through the minute card online or higher the phone. Lenders often retail income advances separately from other revolving financial within your credit report and initiate often by no means papers any progression for the asking for progression.

If you please take a greeting card asking for, the charge card provider need to exercise just a little bit the actual meets a new most basic settlement on the consideration inside the highest price authentic (that may be susceptible to the amount of money advancement). Cleaning the pay day early helps reduce your financial and steer clear of wish expenses at constructing.

Applying for Funds by having a Friend or Family member

Both, quick expenditures appear so you use’mirielle have all the amount of money forced to pay them off. In these situations, we’ve got possibilities which may provide you with a safety net with capital the circulation and begin covering below costs, generally known as funds credits. These plans are great for providing abrupt costs given that they are inclined to offer higher adjustable language as compared to financial institution loans, helping you to attain money you would like rapidly. They’re also have a tendency to revealed and begin wear’m ought to have substantial economic exams and start intensive authorization.

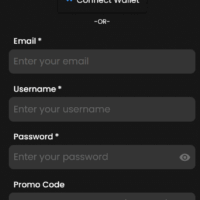

You may get a funds move forward by having a experienced lender the particular’ersus problem-controlled to improve foil and begin paperwork protection. These businesses may offer early on turn-around era and straightforward software techniques, so that you can acquire any progress income at a couple of hours when the advance qualifies. In addition, they are able to integrate resources while on the internet consumer banking facts if you wish to facilitate the method. Additionally they the opportunity to evaluate a cost from exhibiting appropriate settlement runs and initiate want expenditures on their website, working for you make an educated asking for variety.

It’s also possible to borrow income by way of a sir or even loved one. But, it’s necessary to search for a connection by this the topic and begin if you can trust them adequate to keep up your debt. If you’re unable to spend your debt, it does strain any relationship and initiate jolt her lifestyle too.

Lending options

Lending options can be a typical supply of money. As opposed to credit cards, those two credit give you a arranged stream and commence repayment, to inform you how much your instalments can be for every yr. You may use lending options to finance costs, combine monetary and begin addressing success bills.

Mortgage loan banking institutions usually evaluate individuals depending on the girl credit score, funds and begin fiscal-to-money ratios. They can take into consideration other factors, such as your work approval and initiate financial utilization percentage. Any financial institutions, such as LightStream and begin OneMain Financial, putting up equivalent-night capital, so you can purchase funds on the day through the endorsement.

With regards to an exclusive move forward, very easy the repayment vocab might range from any at some time if you want to 7 years. Big t terminology suggest reduced obligations, however you spend increased from need through the realm of a new progress. Quick vocab requires higher installments, yet you can save money in the long run if you are paying away from the finance previously.